Williams Companies Stock: Is WMB Outperforming the Energy Sector?

The Williams Companies, Inc. (WMB), headquartered in Tulsa, Oklahoma, operates as an energy infrastructure company focused on connecting North America's hydrocarbon resource plays to growing markets for natural gas, natural gas liquids (NGLs), and olefins. With a market cap of $69.7 billion, the company owns and operates midstream gathering and processing assets, and interstate natural gas pipelines.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and WMB perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the oil & gas midstream industry. WMB’s strategic strength stems from its robust asset portfolio, featuring key pipeline systems like Transco and Northwest. Strategic acquisitions have expanded its capacity and reach, solidifying its position as a leading midstream player.

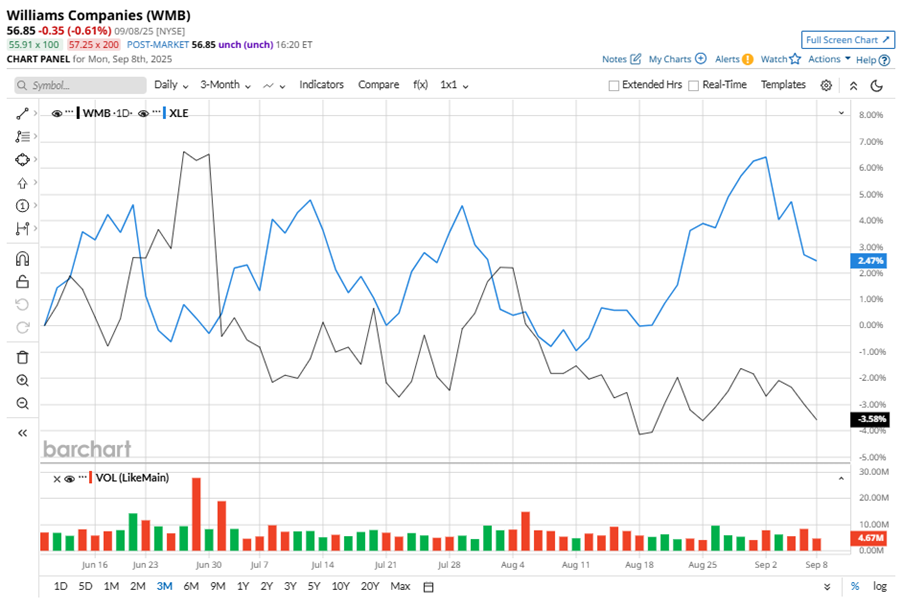

Despite its notable strength, WMB slipped 10.4% from its 52-week high of $63.45, achieved on Jun. 30. Over the past three months, WMB stock declined 6.1%, underperforming the Energy Select Sector SPDR Fund’s (XLE) 4.5% gains during the same time frame.

In the longer term, shares of WMB rose 5% on a YTD basis and climbed 28.5% over the past 52 weeks, outperforming XLE’s YTD gains of 1.8% and 1.3% returns over the last year.

To confirm the bearish trend, WMB has been trading below its 200-day moving average since mid-August, with slight fluctuations. The stock has started trading below its 50-day moving average since early May, with slight fluctuations.

WMB's strong performance was driven by robust results across its segments, fueled by higher service revenues, product sales, and gains from commodity derivatives. Key pipeline expansions, including Transco upgrades, and strategic acquisitions like Saber Midstream, further bolstered its position. Record natural gas flows and increased volumes in regions like Haynesville also contributed to the company's success.

On Aug. 4, WMB shares closed down marginally after reporting its Q2 results. Its adjusted EPS of $0.46 missed Wall Street expectations of $0.49. The company’s revenue was $2.8 billion, falling short of Wall Street forecasts of $3.1 billion. WMB expects full-year adjusted EPS in the range of $2.01 to $2.19.

WMB’s rival, Kinder Morgan, Inc. (KMI) shares lagged behind the stock, with a 3.4% downtick on a YTD basis and 25.3% gains over the past 52 weeks.

Wall Street analysts are reasonably bullish on WMB’s prospects. The stock has a consensus “Moderate Buy” rating from the 21 analysts covering it, and the mean price target of $64.67 suggests a potential upside of 13.8% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.